pro-polyurea.ru

Learn

Current Ee Bond Interest Rate

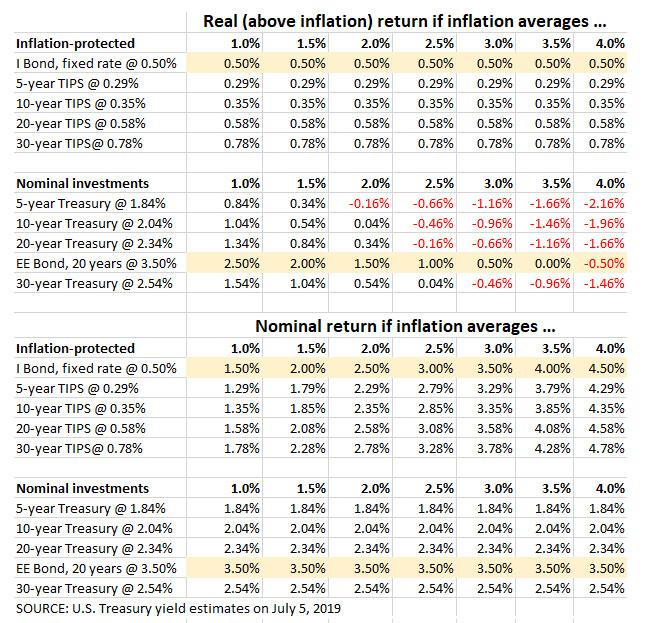

The interest rate for a Series EE bond bearing an issue date of May 1, current redemption value of a definitive Series EE bond presented for payment. Interest Rate 6% per annum. Series EE Savings Bonds were sold at half their face-value. These bonds were exempt from state and local income. Currently, the interest rate is % for series I bonds issued between November 1, and April 30, During periods of deflation, the government. When you buy an I Bond, you receive the current interest rate set by the U.S. Treasury Department. EE Bond interest rates are currently lower than I Bond. I SAVINGS BONDS. Series I bond is a savings bond that earns interest based on combining a fixed rate and an inflation rate. I Bonds can be used to: ▫. Save. Interest is paid once your bond reaches its year maturity or you cash it out. Series I bonds can end up paying a higher rate of interest than a Series EE. Current Interest Rate. Series EE Savings Bonds. %. For savings bonds issued November 1, to April 30, EE bonds at a glance. Electronic or paper. Savings bonds accrue interest until redeemed or until they reach their final maturity in 30 years. The current composite rate (which is the yearly rate that. The interest on I bonds is a combination of Current Interest Rate Series I Savings Bonds % For savings bonds issued November 1, to April 30, The interest rate for a Series EE bond bearing an issue date of May 1, current redemption value of a definitive Series EE bond presented for payment. Interest Rate 6% per annum. Series EE Savings Bonds were sold at half their face-value. These bonds were exempt from state and local income. Currently, the interest rate is % for series I bonds issued between November 1, and April 30, During periods of deflation, the government. When you buy an I Bond, you receive the current interest rate set by the U.S. Treasury Department. EE Bond interest rates are currently lower than I Bond. I SAVINGS BONDS. Series I bond is a savings bond that earns interest based on combining a fixed rate and an inflation rate. I Bonds can be used to: ▫. Save. Interest is paid once your bond reaches its year maturity or you cash it out. Series I bonds can end up paying a higher rate of interest than a Series EE. Current Interest Rate. Series EE Savings Bonds. %. For savings bonds issued November 1, to April 30, EE bonds at a glance. Electronic or paper. Savings bonds accrue interest until redeemed or until they reach their final maturity in 30 years. The current composite rate (which is the yearly rate that. The interest on I bonds is a combination of Current Interest Rate Series I Savings Bonds % For savings bonds issued November 1, to April 30,

Don't you have to pay federal income taxes on I bond profits? So I feel like a lot of people lost interest in I Bonds after the big. Series EE bonds don't pay interest currently. Instead, the accrued interest is reflected in the redemption value of the bond. The U.S. Treasury issues. Page 1. | Appendix B. Table B– Bond yields and interest rates, – [Percent per annum]. Year and month. U S Treasury securities. Corporate bonds. The yield on I bonds is adjusted every six months to the rate of inflation. In May , that yield spiked to a multi-decade high of %, but the current. The interest rate on Series EE Savings Bonds varies depending on when they are purchased. The current interest rate is % (as of January ). The U.S May 1, · I Bond Composite Rate of % includes a Fixed Rate of % · Series EE Bonds Issued May and Later · Series EE Bonds Issued from May A series E/EE bond earns a fixed rate of interest for up to 30 years. A Current Holdings” tab in your account. How do I redeem my savings bonds. This calculator will price Series EE, E, and I bonds and can show you: Current interest rate; Next accrual date; Final maturity date; Year-to-date interest. Fixed Rate Retail Savings Bonds earn a market-related fixed interest rate, which is priced off the current government bond yield curve, and is payable on the. These bonds are also guaranteed to double in value 20 years after their issue date, making the effective interest rate roughly %. The government may change. Through October 31, , the interest rate is %. • Interest is earned monthly, compounding semi-annually, for up to 30 years, unless you cash it sooner. •. For bonds entitled to interest accruals at the short-term savings bond rate, that rate applies to the bond's first full semiannual interest accrual period. The interest rate for Series I Savings Bonds combines two separate rates: A fixed rate of return - remains the same throughout the life of the savings bond. Series I savings bonds, or I bonds, purchased through October , will earn %, TreasuryDirect® announced May 1, This rate includes an inflation. May 1, · I Bond Composite Rate of % includes a Fixed Rate of % · Series EE Bonds Issued May and Later · Series EE Bonds Issued from May EE bonds provide an interest rate of %, and this rate is good through Unlike EE bonds, HH bonds are “current-income securities.” You paid face. The bond is worth its full value upon redemption. The interest is issued electronically to your designated account. You cannot buy more than $10, (face value). Valid 08/15/ - 08/31/ ; BOND, RATE, MATURITY DATE ; 5-Year, %, September 01, yield for the preceding six months. Bonds issued in May or later pay a fixed interest rate for the life of the bond. Paper EE bonds, last sold.

Digital Nomad Lifestyle

Nomads spend a lot of their time alone, and should enjoy it as well. Digital Nomads are trying to deal with the issue of lack of social life by choosing global. I'm Victor, currently living in San Salvador, but since I became a digital nomad, I have lived in many cities in just 9 months. I'm an American who has been a “Digital Nomad” for about 12 years, working fully remotely (mostly as a freelancer) while visiting 31 countries since Articles about the Digital Nomad lifestyle. You'll find articles on minimalism, travel gear and more. Is it possible to find a way to become a digital nomad by continuing your 9–5 work? This was the challenge I measured myself with, and — spoiler alert! — I won. Digital Nomad Lifestyle. In , the world experienced what may go down in history as the greatest paradigm shift of our generation. When people found. The digital nomad lifestyle tends to be flexible, which is a big draw for many people. Many digital nomads say the ability to travel when and where they. Digital nomads are symbols of the “modern human”. They are not bound to an office because they use the world wide web to work – wherever they want, whenever. A nomad life has its pros and cons. In this article we discuss our digital nomad lifestyle and answer your tops questions. Nomads spend a lot of their time alone, and should enjoy it as well. Digital Nomads are trying to deal with the issue of lack of social life by choosing global. I'm Victor, currently living in San Salvador, but since I became a digital nomad, I have lived in many cities in just 9 months. I'm an American who has been a “Digital Nomad” for about 12 years, working fully remotely (mostly as a freelancer) while visiting 31 countries since Articles about the Digital Nomad lifestyle. You'll find articles on minimalism, travel gear and more. Is it possible to find a way to become a digital nomad by continuing your 9–5 work? This was the challenge I measured myself with, and — spoiler alert! — I won. Digital Nomad Lifestyle. In , the world experienced what may go down in history as the greatest paradigm shift of our generation. When people found. The digital nomad lifestyle tends to be flexible, which is a big draw for many people. Many digital nomads say the ability to travel when and where they. Digital nomads are symbols of the “modern human”. They are not bound to an office because they use the world wide web to work – wherever they want, whenever. A nomad life has its pros and cons. In this article we discuss our digital nomad lifestyle and answer your tops questions.

A digital nomad is someone using tech to earn a living and conduct their life in a nomadic manner. Such workers typically work remotely. The Digital Nomad Lifestyle is a fantastic, but often glorified lifestyle. Find out what location independence really means! In today's evolving work landscape, the rise of digital nomads has reshaped traditional workforce trends. This lifestyle, characterized by remote work and. Nowadays, digital nomads are adopting the trend to travel around to establish good connections with other people, share experiences and knowledge, exchange. Pros of a Digital Nomad Lifestyle · Freedom and Flexibility · More Control Over Your Cost of Living · Experiencing Different Cultures · Improved Work-Life. These statistics indicate that the most common type of digital nomad is a caucasian American male between the ages of Digital nomad education in Some digital nomads are perpetual travelers, while others only maintain the lifestyle for a short period of time. While some nomads travel through multiple. Being a digital nomad means having a location-independent and technology-enabled lifestyle. Yes, you got it right. You can work remotely and travel the world. This lifestyle is more than just travel, beautiful pictures, and adventures. It's hard work, sacrifices, and hardships. Nomad Lifestyle. @NickDemski. K subscribers• videos. World Travel Tips and Hacks | Make Money While Traveling | Digital Nomad Lifestyle more more. Choosing the Digital Nomad Lifestyle · Sleep and get up when you want. · Work remotely. · Set your own deadlines. · Choose your partners. · Be passionate about. A lot of people think you have to be incredibly rich and successful to be able to live this kind of lifestyle, and that traveling is an expensive lifestyle. But. Being a digital nomad is not an endless holiday no matter how hard you might try. What we're fed online on social media, etc. usually only shows the bright. If you've ever dreamed of traveling the world while still earning an income, you might be asking “what is the digital nomad lifestyle anyway?” Digital nomads. The digital nomad lifestyle and the digital nomad experience are both popular options for remote workers, but they are not the same thing and have their own. It all started with a Hawaiin shirt or living on my friends couch or Vietnam? I guess to tell the real story of Digital Nomad Lifestyle I have to go back to. Cover photo of Digital Nomad Lifestyle. Digital Nomad Lifestyle. likes. . followers. Sharing the Digital Nomad Lifestyle and Making Friends For Life. At the end of this page you will find all our articles in which we talk about our nomadic lifestyle, how we work remotely but also our expenses and budgets. The digital nomad lifestyle is possible with internet access, smartphones and voice over IP to call clients. The growth of both the gig and creator.

Bank Bonus

Earn $ when opening an eligible Fifth Third checking account with qualifying activities.1 Offer expires September 30, See all terms & conditions. Find current bank account bonus offers from Citibank. Learn about time-limited offers for checking account bonuses, savings account bonuses and more. Enjoy $ as a new Chase checking customer, when you open a Chase Total Checking account 1 and make direct deposits totaling $ or more within 90 days of. Earn up to a $ cash bonus when you open a new SoFi Checking and Savings account online with direct deposit. Take advantage of this promotion today! Dollar Bank offers online banking services including online checking and savings accounts, loans, mortgages, small business banking and corporate banking. Limited-Time Offer: Enjoy up to $ by opening a new checking account with Midland States Bank. Member FDIC. Receive up to a $ bonus with required minimum opening deposit (Associated Access Checking: $25, Associated Balanced or Choice Checking: $) and recurring. This is the Weekly Bank Account Bonus Thread. Use it for anything related to bank accounts and bonuses, such as: Churning mechanisms (DD, etc). Earn An Additional $ When you retain a balance of $25, or more for at least days after account opening or earn $ when you maintain at least. Earn $ when opening an eligible Fifth Third checking account with qualifying activities.1 Offer expires September 30, See all terms & conditions. Find current bank account bonus offers from Citibank. Learn about time-limited offers for checking account bonuses, savings account bonuses and more. Enjoy $ as a new Chase checking customer, when you open a Chase Total Checking account 1 and make direct deposits totaling $ or more within 90 days of. Earn up to a $ cash bonus when you open a new SoFi Checking and Savings account online with direct deposit. Take advantage of this promotion today! Dollar Bank offers online banking services including online checking and savings accounts, loans, mortgages, small business banking and corporate banking. Limited-Time Offer: Enjoy up to $ by opening a new checking account with Midland States Bank. Member FDIC. Receive up to a $ bonus with required minimum opening deposit (Associated Access Checking: $25, Associated Balanced or Choice Checking: $) and recurring. This is the Weekly Bank Account Bonus Thread. Use it for anything related to bank accounts and bonuses, such as: Churning mechanisms (DD, etc). Earn An Additional $ When you retain a balance of $25, or more for at least days after account opening or earn $ when you maintain at least.

You are only eligible for one checking account cash bonus; you cannot open multiple checking accounts and receive multiple cash bonuses. The promo code is. Best Bank Bonuses of September · HSBC Premier Checking · Axos Bank Rewards Checking · BMO Relationship Checking · U.S. Bank Smartly® Checking · Truist One. Earn 20, AAdvantage® bonus miles. To qualify for this offer, you must be a first time Bask Mileage Savings Account customer, open a. Deposit products provided by JPMorgan Chase Bank, N.A. Member FDIC. Get service fee, bonus/account and other important information. Enjoy your bonus. $ for Perks Checking or $ for Platinum Perks Checking will be deposited in your new account within 14 days of meeting requirements. General Bonus Information. Offers Wintrust Mortgage is a division of Barrington Bank & Trust Company, N.A., a Wintrust Community Bank NMLS # Need a reason to open an account? Try $ · Earn a $ reward if you meet our simple direct deposit requirements · Enjoy no fees for Valley ATMs, plus no. Best checking account promotions · BMO: $ Cash Bonus · Bank of America: $ bonus · TD Bank: $ bonus · SoFi: up to $ bonus · Discover: up to $ Requirements to Receive the $ Checking Bonus: (1) Open a new eligible personal checking account online using offer code TWACIS by September 30, , to. Earn up to $ 2 when you open an AIM Checking account. Fulfill a few basic requirements and you'll have a bonus for a weekend getaway or a little something. Earning up to a $ cash bonus is easy. Apply online or visit your local M&T Bank to open an account by October 31, using the promo code. Open a qualifying checking account and earn up to three bonuses for each month that you meet the qualifying activities for the first 90 days of account. I managed to make a little over 13k basically doing nothing. Banks routinely offer a sign up bonus for opening a checking account, and recieving X amount of. To receive the bonus: Open a U.S. Bank Smartly Checking account by September 26, Within 90 days of account opening, enroll in online banking or get the. $ New Account Bonus! New Select Now checking customers can earn a $ cash bonus by opening an eligible checking account between 5/23/24 and 7/28/ Set up. Enjoy up to a $ Bonus. Open a new 2 checking account and earn a $ cash bonus for using the new account within the first 60 days. Earn a $ Bonus. Earn $ when you open a new checking account with a direct deposit. Click 'Learn More' below to see more details and eligibility. To earn the $ bonus and Apple AirPods, open any Fidelity Bank personal checking account before August 31, , and within 60 days of account opening you. Set up direct deposit. To get your checking account bonus, you'll need to set up direct deposit. Don't worry—it's a cinch.

Can I Transfer From Bank To Bank

It's easy to transfer money between your U.S. Bank accounts and accounts at other banks with U.S. Bank mobile and online banking. You can safely control. The bank will require you to provide identification; make sure you have the required identification documents before you attempt to process the transaction. Learn how to transfer money to another bank account · Create your profile · Choose where and how much · Enter who will get the money · Pick your payment option. Transfers can only be made from Canadian dollar bank accounts. Foreign exchange conversion rates and regular account transaction fees may apply. Transfer. To make a bank transfer in person at your bank, you can visit one of your bank's branches, fill out a transfer form with the beneficiary. If you can't transfer money · For 1 to 3 business day transactions, make sure that you added an eligible United States bank account and that you entered the. Learn the simple steps to transfer money between bank accounts. Discover various methods such as online transfers, wire transfers, and mobile banking apps. A bank teller can help you set up many other transfer services, including wire transfers to another bank, state, or country. If you're looking to transfer funds. Move money or setup a future transfer within the Mobile Banking app or Online Banking. Transfers can be set up between your Bank of America accounts, Merrill. It's easy to transfer money between your U.S. Bank accounts and accounts at other banks with U.S. Bank mobile and online banking. You can safely control. The bank will require you to provide identification; make sure you have the required identification documents before you attempt to process the transaction. Learn how to transfer money to another bank account · Create your profile · Choose where and how much · Enter who will get the money · Pick your payment option. Transfers can only be made from Canadian dollar bank accounts. Foreign exchange conversion rates and regular account transaction fees may apply. Transfer. To make a bank transfer in person at your bank, you can visit one of your bank's branches, fill out a transfer form with the beneficiary. If you can't transfer money · For 1 to 3 business day transactions, make sure that you added an eligible United States bank account and that you entered the. Learn the simple steps to transfer money between bank accounts. Discover various methods such as online transfers, wire transfers, and mobile banking apps. A bank teller can help you set up many other transfer services, including wire transfers to another bank, state, or country. If you're looking to transfer funds. Move money or setup a future transfer within the Mobile Banking app or Online Banking. Transfers can be set up between your Bank of America accounts, Merrill.

The Memo field is optional. Any notes you enter will be displayed in your transaction history online, and on your bank statement. Click the Continue button. A bank transfer – also known as a one-off payment – is a quick and easy way to move money to a different account. You can normally do this yourself using. A wire transfer is an electronic transaction that allows you to quickly send a large amount of money. How do I set up an External Bank Account in the Mobile App? · Log in to Online Banking at pro-polyurea.ru or the Mobile App. · Click Transfer & Pay · Click. To Transfer Money Between Accounts in the Mobile App: · Tap Move Money in the Navigation Bar · Tap Transfer Between My Accounts · Follow the on-screen instructions. TRANSFERRING MONEY INTO YOUR ACCOUNT—AFTER ACCOUNT IS OPENED · Within Online Banking, go to the Pay and Transfer tab and select “Make an external transfer,”. Send money to a National Bank client using their account number, from your online bank or National Bank app. How do I activate Interac e-Transfer® Autodeposit? With Bank to Bank Transfers, you can easily move money between your U.S. HSBC deposit accounts and your accounts at other U.S. financial institutions. You can easily transfer money person-to-person using 3rd party apps like Venmo, PayPal, Apple Cash and Cash App. All you need is RBC Cross-Border Banking. Once Wise receives and converts your money, it usually takes 1 working day to arrive in your recipient's bank account. Conversion can take up to 2 working days. Say you have a checking account with a bank that has a physical branch near you, but you've opted for an online-only savings account. You can transfer money. You can fund payments from your accounts at Wells Fargo or other U.S. pro-polyurea.rute 1. Bank-to-bank transfers. Transfer money between your accounts at. Yes, money can be transferred from one account to another of different bank. · For this one can use IMPS(Immediate Payment Services), NEFT. Once you initiate the transfer, your recipient doesn't need to do anything at all - the funds will be automatically deposited into their bank account as soon as. You need the recipient's name, address and bank information, including SWIFT code and account number. You can send in U.S. dollars or foreign currency; cutoff. If you have the recipient's account number and routing number, there is another way you can transfer money from your bank account into that account. A routing. These types of transfers can be done through wire transfers or through a mobile payment app. To complete a transfer, your bank will communicate directly with. With Bank to Bank Transfers, you can easily move money between your U.S. HSBC deposit accounts and your accounts at other U.S. financial institutions. You can transfer funds among all of your business accounts except your business Certificate of Deposit (CD). Transfers from Business Credit Express line of. Whether it's direct-to-bank deposit with Scotia International Money* or cash pick-up with Western Union♢, you can send your money the way you want. Send money.

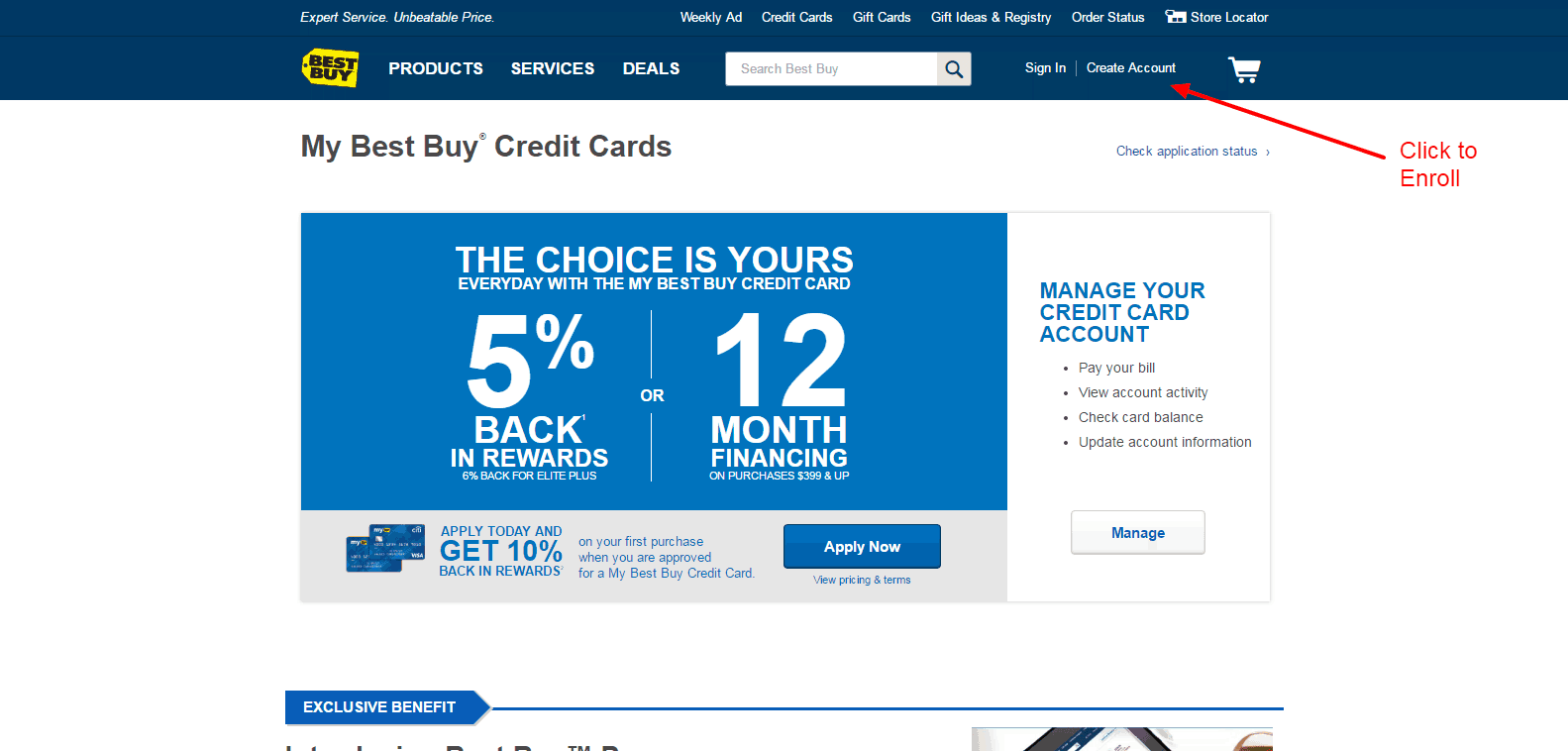

Bestbuy Credit Card Bank

Shop for pay best buy credit card citi at Best Buy. Find low everyday prices and buy online for delivery or in-store pick-up. Earn up to 2X BreezePoints on No Flex Fares, that's 1X when you buy, plus 1X when you fly © Barclays Bank Delaware, Member FDIC Credit Card. Get the most out of your Card. Learn about rewards* when you spend outside of Best Buy with the My Best Buy® Visa® Card. Play Video. We partner with the world's leading brands to build innovative financing programs based on business goals. We specialize in Consumer Electronics. Buy the latest TVs, phones, appliances and more with Samsung financing. You can manage your Samsung Financing account online on the TD Bank website anytime to. Shop for best buy credit card app at Best Buy. Find low everyday prices and buy online for delivery or in-store pick-up. Online Bill Pay · Enrollment or Changing Bank Account · Payments · Same Day Crediting · Authorization. So I just applied for the best buy credit card and got this message, " Thanks for your application. Please call Citibank N.A. using the. My Best Buy ® Visa ® Card. Earn rewards faster and take advantage of even more exclusive offers by upgrading to the My Best Buy ® Visa ® Card. Shop where Visa®. Shop for pay best buy credit card citi at Best Buy. Find low everyday prices and buy online for delivery or in-store pick-up. Earn up to 2X BreezePoints on No Flex Fares, that's 1X when you buy, plus 1X when you fly © Barclays Bank Delaware, Member FDIC Credit Card. Get the most out of your Card. Learn about rewards* when you spend outside of Best Buy with the My Best Buy® Visa® Card. Play Video. We partner with the world's leading brands to build innovative financing programs based on business goals. We specialize in Consumer Electronics. Buy the latest TVs, phones, appliances and more with Samsung financing. You can manage your Samsung Financing account online on the TD Bank website anytime to. Shop for best buy credit card app at Best Buy. Find low everyday prices and buy online for delivery or in-store pick-up. Online Bill Pay · Enrollment or Changing Bank Account · Payments · Same Day Crediting · Authorization. So I just applied for the best buy credit card and got this message, " Thanks for your application. Please call Citibank N.A. using the. My Best Buy ® Visa ® Card. Earn rewards faster and take advantage of even more exclusive offers by upgrading to the My Best Buy ® Visa ® Card. Shop where Visa®.

The Best Buy Credit Card is a good card that's worth applying for if you pay your bill in full every month and regularly shop at Best Buy. Its most notable. However, Best Buy does also offers the Best Buy Mastercard or Visa credit card that can be used anywhere MasterCard-branded cards are accepted. Pick the type of rewards that work best for you. Earn every time, everywhere. Earn rewards every time you use your card to make a purchase. Redeem. Use. For consumers and pros alike, Home Depot offers convenient credit card options to extend their purchasing power as well as manage and pay their account. Our. Learn more about My Best Buy Credit Card, including financing offers, rewards, and how to manage your account. Corporate Purchasing Card · Personal Card Annual Credit. Gift Cards. View Get a $30 statement credit by using your enrolled eligible Card to spend a. Interested in the My Best Buy® Credit Card? Apply today and get 10% back* in rewards on your first day of purchases when you are approved for the Card. The Gold card is the option Citi bank approves you for if the don't like your credit report enough to approve you for the $0 annual fee, but. Best Buy, the electronic superstore giant, offers two types of credit cards. Both are issued by Citi Bank, which earns rewards when shoppers purchase items from. The card doesn't charge an annual fee. Cons. Rewards are issued as certificates that can only be used at Best Buy or bestbuy. The My Best Buy® Credit Card offered by Best Buy® and Citibank allows you to access reward and financing options for your Best Buy® Purchases. Mon - Fri 9 a.m. - 9 p.m. local time. Saturday 8 a.m. - 8 p.m. local time. Sunday 8 a.m. - 6 p.m. local time · My Best Buy® Credit Card. P.O. Box. Personal checks, business check or cashier's checks; Cash. Combining payment methods on pro-polyurea.ru orders: You can't use more than one credit card. SIGN OFF · Are You Sure You Want to Quit? · You Are Leaving a Citibank Website and Going to pro-polyurea.ru · Your Session Is About to Time Out · Welcome to. Citi Bank/Best Buy Credit Card Company has the worst consumer service ever. I pay about $5, a month in credit card payments, every month, never late. Reward certificate: Reward certificates are coupons for discounts off future purchases at Best Buy® stores and pro-polyurea.ru®. 18 month financing details: Offer. Loans are made or arranged pursuant to California Financing Law license 60DBO The Affirm Card is a Visa® debit card issued by Evolve Bank & Trust. Best for Bank of America customers: Bank of America Unlimited Cash Rewards Credit Card buy, plus an additional 1% as you pay for those purchases. Let's say you purchase a laptop for $1, on a 24 month deferred interest plan with an Annual Percentage Rate (APR) of 26%. (The APR on your credit card may be. *Get points per $1 spent (5% back in rewards) on qualifying Best Buy® purchases when you choose Standard Credit with your My Best Buy® Credit Card. Points.

Portable Blender Frozen Fruit

PopBabies portable blenders are strong enough to crush ice cubes, frozen fruits, seeds and works efficiently and save your time. You can take this handy bottle. A powerful DC motor can handle fruits, veggies and small ice cubes, while the oz Blending Bottle holds the perfect amount for a single serving. NINJA® POWER: Blast through fresh or frozen ingredients and ice. · LARGE CAPACITY: Makes up to 18 oz. · PREMIUM COLORS: Choose a color that best fits your style. Cordless Blender for Life On the Go: Blend shakes per charge with this USB-rechargeable blender! · Crush Ice or Prep Protein Shakes and Smoothies. This thing is kinda wicked for a portable blender. Actual blades with a motor strong enough to drive them. Frozen fruit will blend. Powers will not clump up. Just freeze fruit, spinach and protein powder in baggies, add some coconut milk or yogurt with it in the blender and poof! Perfect, delicious smoothie on the go. Ninja Fit Compact Personal Blender, Portable Blender for-Smoothies, Shakes, Food Prep, and Frozen Blending, Watt Base, (2) oz. Cups and Spout Lids, Black. PORTABLE BLENDER · Drink straight from the blender & enjoy delicious drinks on-the-go · Powerful motor blends ice, frozen fruit, nuts & seeds! · Large mL. Magic Bullet Portable Blender: This blender is easy to use (there's only one button) and has a favorable price tag, but it struggled with frozen fruit and ice. PopBabies portable blenders are strong enough to crush ice cubes, frozen fruits, seeds and works efficiently and save your time. You can take this handy bottle. A powerful DC motor can handle fruits, veggies and small ice cubes, while the oz Blending Bottle holds the perfect amount for a single serving. NINJA® POWER: Blast through fresh or frozen ingredients and ice. · LARGE CAPACITY: Makes up to 18 oz. · PREMIUM COLORS: Choose a color that best fits your style. Cordless Blender for Life On the Go: Blend shakes per charge with this USB-rechargeable blender! · Crush Ice or Prep Protein Shakes and Smoothies. This thing is kinda wicked for a portable blender. Actual blades with a motor strong enough to drive them. Frozen fruit will blend. Powers will not clump up. Just freeze fruit, spinach and protein powder in baggies, add some coconut milk or yogurt with it in the blender and poof! Perfect, delicious smoothie on the go. Ninja Fit Compact Personal Blender, Portable Blender for-Smoothies, Shakes, Food Prep, and Frozen Blending, Watt Base, (2) oz. Cups and Spout Lids, Black. PORTABLE BLENDER · Drink straight from the blender & enjoy delicious drinks on-the-go · Powerful motor blends ice, frozen fruit, nuts & seeds! · Large mL. Magic Bullet Portable Blender: This blender is easy to use (there's only one button) and has a favorable price tag, but it struggled with frozen fruit and ice.

It's got exceptional power for mixing up smoothies and shakes with ice and fruit and taking those drinks on the go. –Jody Ninja Blast™ Portable Blender Forest. Product Description High-performance Fruit Mixer: the OTE smoothie mixer can crush ingredients in 3 seconds, with 4 spoiler chords that stir completely. Not all blenders can crush ice or frozen fruit, but we're happy to tell you Blendaco is able to do this. Blendaco may be small, but it's quite mighty - it's a. 16 Oz To-Go Sports Bottle, + Online Recipes, for Kitchen, Frozen Fruit, Ice, Nut Red- Other Kitchen Appliances at SHEIN. Not only is it seriously budget-friendly, but the NutriBullet GO Portable is capable of blending most fresh fruits with ease. It was great at taking on berries. Portable Blenders Bottle oz ml,Hioo Personal Size Blender mAh W for Shakes and Smoothies Margarita Protein Frozen Fruits Mini Cordless Juicer. New Arrival · How to use: · Step 1: Cut the fruit into small pieces (fill up 60% of the jar capacity); Step 2: Add your favorite drink (fill up 80% of the jar. Been using the original NutriBullet for over 5 years and it still works as good as the day I got it! I've been blending frozen fruit with greens. This amazing 14 oz juice blender can help you stay healthy and enjoy your favorite smoothie everywhere with a detachable top that you can use as your personal. blend fresh fruit, small frozen fruits, and nutritional powders with ease PERSONAL BLENDER KEEPS UP WITH YOU: The Oster Blend Active Portable Blender. CRUSHING ICE IS A BREEZE: This 18oz rechargeable blender that crush ice was upgraded with 6 sharp and serrated blades that can blend ice and frozen fruits or. Buy Powerful Portable Blender - Crush Ice and Frozen Fruits for Smoothies and Shakes at pro-polyurea.ru Mix protein powders, chop frozen fruit, and even crush ice. When you're done, fully convert it into a functional water bottle that can be easily transported. A Hamilton Beach® Personal Blender lets you mix a quick, tasty drink, and then grab and run. Each single-serve blender cup has a no-spill travel lid integrated. The best portable blender out there! This is the best blender I've ever owned. It's quiet, lightweight, and it blends everything (frozen fruit, ice, nuts). Best Buy customers often prefer the following products when searching for frozen fruit blender. ; Ninja - Blast 18 oz. Portable Blender - Passion Fruit Purple. NutriBullet Portable Blender · Includes · User Guide · Features. Pointed power- A 4-point stainless steel, performance-optimized blade smooths out frozen fruit. Frozen fruit blenders are kitchen appliances used to make smoothies and milkshakes, crush ice, and mix other ingredients. There are two main types of blenders. With our high-powered motor spinning at 20,rpm, your Fresh Juice blends through the ice, nuts, frozen fruit, leafy greens and more in seconds flat. Self. Nine lithium-ion batteries give you the power to blend ice, frozen fruit, and other solid ingredients on the go. Our Technology. Most Portable Blender.

Life Alert Cost Medicare

AARP members save 15% on Lifeline Medical Alert Service and get free shipping and activation. Learn more about this service now. Free Equipment. There's no charge for hardware. Your medical alert device will be provided to you as a part of your service plan. No, not usually. Original Medicare (Part A and B) won't cover your medical alert device, but Part C (also called the Medicare Advantage Plan) might through the. *Requires month-to month agreement and $99 activation fee. Excludes taxes. First month monitoring (twelve months for annual billing) due at. Lifeline is a medical alert service that provides help at the touch of a button (or automatically with our AutoAlert falls detection button). Telephone alert systems are not covered because they are not considered by Aetna to fall within the contractual definition of DME in that they are normally of. Medicare generally does not cover medical alert systems, but you may be able to get help paying for them in other ways. + lives saved! Life Alert saves a life from a catastrophe every 11 minutes. 24/7 help for fall, medical, shower, out of home emergencies. Life Alert's monthly monitoring fees range from $ to $ or more depending on which options you choose. They also charge a one-time membership fee of $. AARP members save 15% on Lifeline Medical Alert Service and get free shipping and activation. Learn more about this service now. Free Equipment. There's no charge for hardware. Your medical alert device will be provided to you as a part of your service plan. No, not usually. Original Medicare (Part A and B) won't cover your medical alert device, but Part C (also called the Medicare Advantage Plan) might through the. *Requires month-to month agreement and $99 activation fee. Excludes taxes. First month monitoring (twelve months for annual billing) due at. Lifeline is a medical alert service that provides help at the touch of a button (or automatically with our AutoAlert falls detection button). Telephone alert systems are not covered because they are not considered by Aetna to fall within the contractual definition of DME in that they are normally of. Medicare generally does not cover medical alert systems, but you may be able to get help paying for them in other ways. + lives saved! Life Alert saves a life from a catastrophe every 11 minutes. 24/7 help for fall, medical, shower, out of home emergencies. Life Alert's monthly monitoring fees range from $ to $ or more depending on which options you choose. They also charge a one-time membership fee of $.

Currently, medical alert systems are not eligible to be covered by Medicare. What is the difference between personal emergency response systems (PERS), medical. UnitedHealthcare (“UHC”) to Offer Lifeline® Personal Emergency Response System (“PERS”) at No Cost to Covered Medicare-Eligible Retirees · UnitedHealthcare (“UHC. A medical alert bracelet is worn around the wrist. It has information about your identity and your medical condition. This can help emergency care providers. Call for help in any emergency, large or small, with a medical alert device. These systems are a type of assistive technology that triggers alerts. Lifeline is an easy-to-use medical alert system that lets you summon help any time of day or night – even if you can't speak. All you need to do is press your. Our "HOME" annual plan pricing is just $ a month. If you need an extra medical alert button, they are available for a small cost of $ - $ Medical Alert Plus (4G) Includes in-home operations, optional fall detection You are now navigating away from the Medicare section of the Independent Health. Medical alert systems with push buttons start at $ Get peace of mind with home & mobile systems or fall detection. Continuous safety monitoring. Your medical alert base station is protected under a warranty with Bay Alarm Medical as long as the issue occurred because of normal “wear and tear,” or. The official U.S. government website for Medicare, a health insurance program for people age 65 or older and younger people with disabilities. Original Medicare does not cover medical alert systems. Medicare Advantage plans may cover the devices. Medicaid may also help with costs. Read more. Original Medicare does not cover personal emergency response systems.” But the short answer isn't comprehensive, nor is it complete. That's because many older. Original Medicare (Part A and Part B) doesn't cover the cost of medical alert systems for beneficiaries. However, many Part C plans provide this coverage. If. Medical Guardian's award-winning alert devices offer a variety of features for different lifestyles and the price of each device depends on which features and. Our clients pay a monthly fee (around $1 a day, depending on the features) for the medical alert monitoring service, and we provide the equipment for them to. Your Humana Medicare Advantage benefits plan will not include Lifeline Personal Emergency Response in Your Humana plan offers a discount for Lifeline. Medicare Advantage Plans BayCare HomeCare is extremely excited to partner with VRI to bring you a remarkable line of reliable and innovative medical alert. However, it's possible Medicare Advantage, also known as Part C, may cover the cost of medical alarms. Medicare Advantage is private coverage available to. does not cover medical alert systems. However, some Medicare Advantage (Part C) plans and private insurers do offer coverage. Some long-term care insurance. Save 40% Off a HandsFree Health Medical Alert System Plus Save Each Month on Monitoring · $ (Regularly $) · Monthly Subscription $ (Regularly.

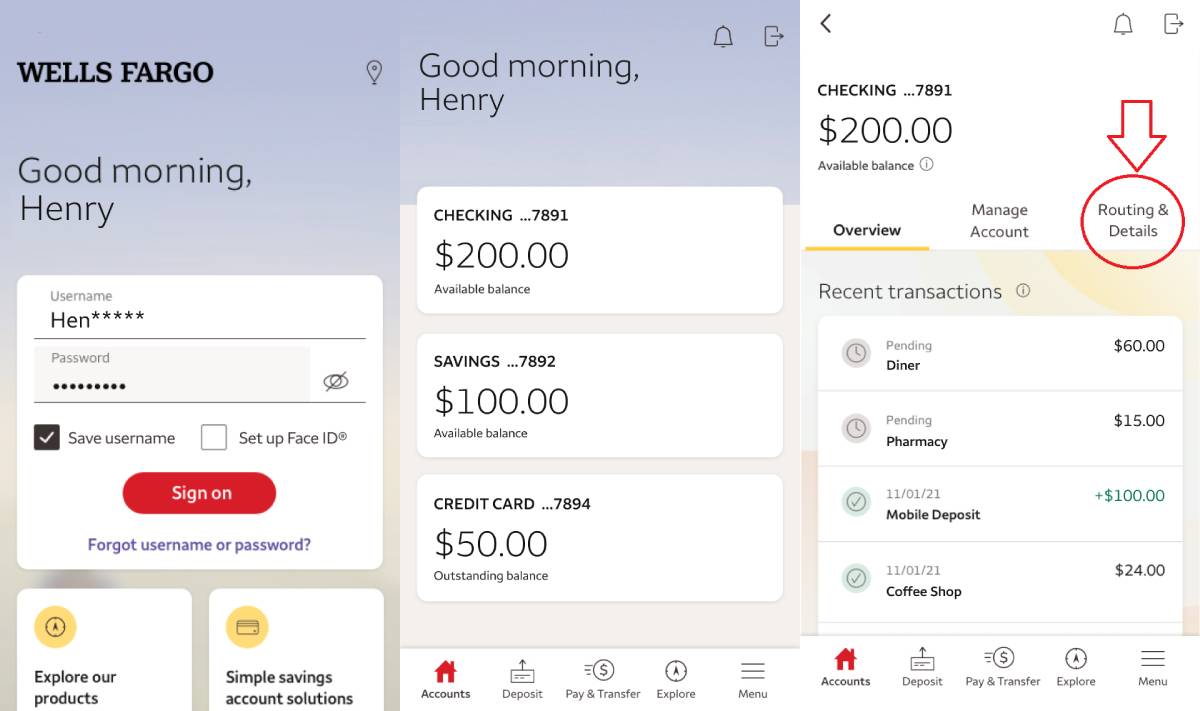

Routing Number Online Banking

Where is my bank routing number online? · Go to pro-polyurea.ru and log into your account · Click “My Accounts” · Click the appropriate account number · Click the. When you send or receive money directly from your bank account in transactions like electronic payments, banks need to know where that money is supposed to go. Routing Number is a 9-digit identification number commonly found at the bottom of a check, used by financial institutions to identify where a bank account is. Online Banking. SmartBank is committed to offering the most efficient Routing Number: b · a · j. All content Copyright © , SmartBank. How to find your routing number online · On this website – We've listed routing numbers for some of the biggest banks in the US. · Online banking – You'll be able. The Service permits authorized Users to receive online access to individual ABA Routing Numbers (the unique nine digit number used to identify the paying. Routing and account number information is easily available for Chase customers. You can consult our app, go online, or locate the numbers on your checks. It's the second set of numbers printed on the bottom of your checks, just to the right of the bank routing number. Sign into online banking. Click on Accounts. Routing numbers are nine digit numbers that can also be referred to as banking routing numbers, routing transit numbers, RTNs, and ABA numbers. Where is my bank routing number online? · Go to pro-polyurea.ru and log into your account · Click “My Accounts” · Click the appropriate account number · Click the. When you send or receive money directly from your bank account in transactions like electronic payments, banks need to know where that money is supposed to go. Routing Number is a 9-digit identification number commonly found at the bottom of a check, used by financial institutions to identify where a bank account is. Online Banking. SmartBank is committed to offering the most efficient Routing Number: b · a · j. All content Copyright © , SmartBank. How to find your routing number online · On this website – We've listed routing numbers for some of the biggest banks in the US. · Online banking – You'll be able. The Service permits authorized Users to receive online access to individual ABA Routing Numbers (the unique nine digit number used to identify the paying. Routing and account number information is easily available for Chase customers. You can consult our app, go online, or locate the numbers on your checks. It's the second set of numbers printed on the bottom of your checks, just to the right of the bank routing number. Sign into online banking. Click on Accounts. Routing numbers are nine digit numbers that can also be referred to as banking routing numbers, routing transit numbers, RTNs, and ABA numbers.

The Routing Number is also called an ABA number or routing transit number. You can find it in the lower left-hand corner of your checks. Bank First will be. Site Map · Internet Privacy Policy · DownloadOrigin Bank's Mobile App. Routing Number: SWIFT Code: CTUUUS Origin Bank NMLS# © Origin. Commerce Bank's routing number is Questions about which account is right for you? Compare account choices or just give us a call if you need. Your account number is located at the top of your online or paper statement. Look at a check. Your account number is located along the bottom of your check, to. Sign on to online banking and select your account · Click your account name · Account and Routing Number will appear to the right under Account Info. It's easy to find your account number and routing numbers for both wire transfers 1 and ACH transactions right in our app. Our New Online Banking & Mobile App is Here! Click here to learn more Routing Number: Call Center: Telephone Banking: Click “Show Account Details” (located under your balance in the upper right corner) and both your routing number and account number will appear. Screenshot of. Your account number is located at the top of your online or paper statement. Look at a check. Your account number is located along the bottom of your check, to. Our New Online Banking & Mobile App is Here! Click here to learn more Routing Number: Call Center: Telephone Banking: On this website – We've listed routing numbers for some of the biggest banks in the US. · Online banking – You'll be able to get your bank's routing number by. A routing number is a unique, nine-digit number that identifies your bank in a financial transaction. You'll need your bank's routing number for financial tasks. Routing numbers (also known as ABA or routing transit numbers) are codes used to identify your bank in a transaction. Think of it like an electronic address for. Your routing number is a sequence of nine numeric characters used by banks to identify specific financial institutions within the United States. A routing. You'll find Dime Community Bank's routing/transit information at the bottom of your Dime Community Bank checks, right before your account number and the check. Your bank's routing number and your checking account number are used when writing a check and sending or receiving an electronic funds transfer. The routing. When you send or receive money directly from your bank account in transactions like electronic payments, banks need to know where that money is supposed to go. Online education center · FDIC Insurance Calculator. ×. For hour telephone banking, call: Bank of Ann Arbor Routing Number: Bank. Your routing number is also located on the bottom of your checks. It's the first set of nine numbers, on the left, and starts with a "0", "1", "2", or "3". Online Banking Login · Sierra Switch Kit · Locations · Sitemap · Disclosures · Accessibility Statement; Routing# ; NMLS# Bank Of The Sierra. ©.

Reprogram Sim Card

Gialer LTE Cards Program kit, SIM Card Tools & Accessories Include 1 SIM Card Reader + 5pcs programmable USIM Cards + 1 Mini Micro Nano sim Card Adapter kit. The latest generation of SIM cards, called the eSIM for embedded SIM cards, is a reprogram mable chip embedded inside a device (smartphone, tablet, wearable or. LTE Cards Program kit, SIM Card Tools & Accessories Include 1 SIM Card Reader + 5pcs programmable USIM Cards + 1 Mini Micro Nano sim Card Adapter kit +. 2 - Insert the SIM card into an older cell phone, preferably one that does not have VoLTE capability. 3 - Program the conditional call forwarding numbers onto. 2G 3G 4G SIM personalize programmable tools software program blank SIM cards ICCID, IMSI, KI, OPC, PUK, ADM,GSM +2pcs SIM cards ; Model NumberSIM Personalize. This Java program defines a SimCard class that takes a phone number as a parameter in its constructor. When you duplicate a SIM card, you essentially remove these two secret numbers and reprogram them into a new, empty card called a wafer. This tricks the. Learn how to manage physical SIM cards and/or eSIM. Find out what kind of SIM your mobile device has. Understand how to activate, unlock or replace a SIM card. Use this page to update a SIM card number in Account Hub. Change a SIM card Visit the Account Hub User Management page if you cannot complete these steps. Gialer LTE Cards Program kit, SIM Card Tools & Accessories Include 1 SIM Card Reader + 5pcs programmable USIM Cards + 1 Mini Micro Nano sim Card Adapter kit. The latest generation of SIM cards, called the eSIM for embedded SIM cards, is a reprogram mable chip embedded inside a device (smartphone, tablet, wearable or. LTE Cards Program kit, SIM Card Tools & Accessories Include 1 SIM Card Reader + 5pcs programmable USIM Cards + 1 Mini Micro Nano sim Card Adapter kit +. 2 - Insert the SIM card into an older cell phone, preferably one that does not have VoLTE capability. 3 - Program the conditional call forwarding numbers onto. 2G 3G 4G SIM personalize programmable tools software program blank SIM cards ICCID, IMSI, KI, OPC, PUK, ADM,GSM +2pcs SIM cards ; Model NumberSIM Personalize. This Java program defines a SimCard class that takes a phone number as a parameter in its constructor. When you duplicate a SIM card, you essentially remove these two secret numbers and reprogram them into a new, empty card called a wafer. This tricks the. Learn how to manage physical SIM cards and/or eSIM. Find out what kind of SIM your mobile device has. Understand how to activate, unlock or replace a SIM card. Use this page to update a SIM card number in Account Hub. Change a SIM card Visit the Account Hub User Management page if you cannot complete these steps.

ReProgram SIM Card · SIM Card readers · SIM Sniffer · Program SIM Tool · Fuzzing & Security. How to install or change a SIM or SD memory card on Galaxy phone · 1 Lift the back cover off your device. · 2 Remove the battery · 3 Carefully slide your SIM or. cards for cellular networks, so-called SIM cards. Many Osmocom (Open Source Program customizable SIMs · pySim-read · pySim-read usage · pySim library. What should I do if I brought a new SIM card and want to transfer the service from my previous SIM card? reprogram my Remote Alert System? I tried to. You can use simLAB tool for reading and editing almost any SIM file. It works with every PC/SC smartcard reader. The tool also allows you to backup SIM file. For more information please refer to the user manual which includes a card specification as well as examples on how to use and re-program the cards using freely. On pro-polyurea.ru, you can find a range of options when it comes to wholesale program sim card for mobile phone. We have mobile phone sim cards that are. Pop out the SIM tray with a removal tool. 5. Swap the SIM cards. 6. Replace the tray. 7. Turn your phone back on. Unlike traditional plastic SIM cards, eSIMs can be reprogrammed at any time. They consist of software that is downloaded to a pre-installed microchip on. ReProgram SIM Card · SIM Card readers · SIM Sniffer · Program SIM Tool · Fuzzing & Security. To program it, you will need first a card sim reader like the HID OMNIKEY R On the software side, you can use the pySim-shell for changing. Can i change my sim card to a different telephone number @Meljel0: Your son needs to call CS with both of them available on the line to effect a change of. ## Understanding SIM Card Programming SIM card programming involves reading the data from a SIM card and writing new information onto it. This can include a. The built-in level shifter translates the input signal to the external SIM card CLK input. 7. RESET. INPUT. The RESET signal present at this pin is connected to. Added feature to set “service provider name” (SPN) This name is displayed on the UE as operator name. So, setting SPN different on each card is a convenient. It cannot be reprogrammed to support other carriers. Device, Model, Nano SIM Card, MFF2 SMD SIM. Boron 2G/3G, BRN BRN, ✓, ✓. This Java program defines a SimCard class that takes a phone number as a parameter in its constructor. pySim is a suite of programs (develped in python) for interfacing with SIM/UICC/USIM/ISIM cards. Such SIM/USIM cards are special cards. sim card - uicc card - programmer. pySim is a suite of programs (develped in python) for interfacing with SIM/UICC/USIM/ISIM cards. Such SIM/USIM cards are special cards.

Borrowing Money From 401k For Down Payment

Repayment of the loan must occur within 5 years, and payments must be made in substantially equal payments that include principal and interest and that are paid. With most loans, you borrow money from a lender with the agreement that you will pay back the funds, usually with interest, over a certain period. With (k). Keep in mind, you can only take out a loan of 50% of your vested account balance, so $15k (if vested). Normally the maximum loan is five years. The amount you receive is limited: You can borrow 50% of your vested account balance or $50,, whichever is less. You must fully pay back what you borrowed. What to know before taking funds from a retirement plan · Immediate and costly tax penalty. Dipping into a (k) or (b) before age 59 ½ usually results in a. 3 Reasons Not to Borrow From Your k · 1. You're missing out on investment growth · 2. It's another monthly expense · 3. You're risking a balloon payment. Your (k) plan may allow you to borrow from your account balance. However, you should consider a few things before taking a loan from your (k). (k) loans are not to be confused with (k) hardship withdrawals. A hardship withdrawal isn't a loan and doesn't require you to pay back the amount you. Borrowing from your (k) may help cover your required % down payment for an FHA loan or 20% down payment for a conventional loan, meaning you can avoid. Repayment of the loan must occur within 5 years, and payments must be made in substantially equal payments that include principal and interest and that are paid. With most loans, you borrow money from a lender with the agreement that you will pay back the funds, usually with interest, over a certain period. With (k). Keep in mind, you can only take out a loan of 50% of your vested account balance, so $15k (if vested). Normally the maximum loan is five years. The amount you receive is limited: You can borrow 50% of your vested account balance or $50,, whichever is less. You must fully pay back what you borrowed. What to know before taking funds from a retirement plan · Immediate and costly tax penalty. Dipping into a (k) or (b) before age 59 ½ usually results in a. 3 Reasons Not to Borrow From Your k · 1. You're missing out on investment growth · 2. It's another monthly expense · 3. You're risking a balloon payment. Your (k) plan may allow you to borrow from your account balance. However, you should consider a few things before taking a loan from your (k). (k) loans are not to be confused with (k) hardship withdrawals. A hardship withdrawal isn't a loan and doesn't require you to pay back the amount you. Borrowing from your (k) may help cover your required % down payment for an FHA loan or 20% down payment for a conventional loan, meaning you can avoid.

FHA: You are allowed to use a K loan. You do not have to factor the payment in to your debt ratio. USDA: You are allowed to use a K loan. You do not have. Borrowing limits. When taking a (k) loan, you can generally borrow the lesser of 50% of your vested balance or $50, · Loan repayment · Loan interest. Many borrowers use money from their (k) to pay off credit cards, car loans and other high-interest consumer loans. On paper, this is a good decision. The You can borrow up to 50% of your vested account balance, not exceeding $50, However, the borrowing cap may be reduced if you had another loan from any. With a (k) loan, you borrow money from your retirement savings account. Depending on what your employer's plan allows, you could take out as much as 50% of. If you're disciplined, responsible, and can manage to pay back a (k) loan on time, great—a loan is better than a withdrawal, which will be subject to taxes. Texa$aver allows a maximum of two loans per Plan. Examples: If your balance is $1,–$10,, you may borrow the entire balance (as long as the $50 loan. Borrow against your (k). Borrowing from your (k) is generally the more advantageous option if you want to tap your plan for a down payment. If your. Texa$aver allows a maximum of two loans per Plan. Examples: If your balance is $1,–$10,, you may borrow the entire balance (as long as the $50 loan. Some employers allow (k) loans only in cases of financial hardship, but you may be able to borrow money to buy a car, to improve your home, or to use for. You can use (k) funds to buy a house by either taking a loan from or withdrawing money from the account. However, with a withdrawal, you will face a penalty. What happens if you leave your job before the loan is paid off? Although you generally have up to five years to repay loans from your (k) plan account. Most plans will allow you to take money out of your (k) for what's called a hardship withdrawal. That means you have to prove to your employer and your (k). And if you're younger than 59 ½ and don't pay your loan back in time, the money will be considered an early withdrawal. This means you'll have to pay a 10%. Unlike loans, withdrawals do not have to be paid back, but if you withdraw from your (k) account before age 59½, a 10% early withdrawal additional tax may. A (k) loan allows you to take out a loan against your own (k) retirement account, or essentially borrow money from yourself. While you'll pay interest. Borrowing from yourself. Borrowing from a retirement plan to fund a down payment is becoming increasingly popular. It can be a great tool, but you need to be. You may consider taking a loan on your (k) if you have a one-time demand that requires a lump-sum cash payment—or an emergency that blocks your normal. You can borrow up to 50% of your vested account balance, not exceeding $50, However, the borrowing cap may be reduced if you had another loan from any. You can borrow money from your retirement plan and pay the funds back with lower interest rates than other types of borrowing, such as a credit card. However, a.

1 2 3 4 5